Why Brands Face POACHERS on Amazon and What to Do About It

1 May, 2022

In a previous blog post, we discussed at greater length the challenges with actionable data missing from your vendor central. This blog post is an excerpt focused on the topic of brand sell-out generated by Poachers.

What Are Poachers?

If you look up the merriam-webster dictionary definition, a poacher is “one who kills or takes wild animals (such as game or fish) illegally”.

What on earth does this have to do with your Amazon sales?

Think of them as sales made by other sellers on your approved assortment. Yes they are playing on your official pages, trying to secure transactions away from your preferred partners.

Maybe you heard about the Buy Box ?

That’s where the battle is raging, the Buy Box or the “default sale” is how you secure North of 90% of transactions on any product page. People fight hard on price and delivery details to secure the Buy Box. When these sellers start securing the Buy Box for your official pages, this significantly impacts your P&L.

Do you see now why “poachers” are an appropriate name? They can kill off profits and sell-outs.

Where Do Poachers Come From?

The problem of competing sellers on your official Amazon product pages is inherent to the nature of the platform but not exclusively. If you are like our clients, it all starts with the ongoing massive fragmentation of physical distribution channels. For your historical wholesalers and retailers, Amazon represents a business opportunity they cannot ignore or neglect. The potential online brand sell-out to be generated on the platform can make some heads turn and nobody wants to be the last-mover.

The second reason behind the presence of poachers relates obviously to the Amazon Flywheel. As we often like to remind ourselves, increasing the number of sellers is an objective for Amazon because a growing number of sellers contributes to increasing the selection (assortment) available to Amazon consumers, therefore improving (i) the Customer eXperience (CX), (ii) the attractiveness of the ecosystem, and therefore (iii) its profitability.

Last but not least, once you have settled on your official product pages, they (most of the time) become references and bring a significant amount of traffic. Even without Amazon Advertising, your official business will attract unwanted attention from other sellers. Soon enough, these sellers will start fighting you on the Buy Box (or default sale) to secure some of the brand sell-out.

Measure Their Negative Impact on Your Business

The Amazon Buy Box attribution model remains a black box to most, but the certainty of the model lies in the importance of a measured combination of inventory x delivery speed x price.

- If you don’t have inventory to sell, no chance to get the Buy Box.

- If you deliver way slower than competition (Amazon 1P being the best in delivery for obvious reasons), securing the default sale is a big challenge.

- Lastly if you don’t secure a decent price, or even the cheapest offering, your chances are thin.

In this context you might understand the recommendation of many to secure inventory combined with the powerful Amazon 1P’ speed of delivery with a decent pricing.

However, this does not cut it and some other sellers might secure temporarily the Buy Box and secure significant brand sell-out. A daily monitoring of the Buy Box becomes essential to adapt your combination (inventory x delivery speed x price). In your Amazon Vendor Central is displayed the Lost Buy Box (LBB) rate to inform on your lack of performance.

Is there any way to understand which factor in your combination cost you the Buy Box at this point in time?

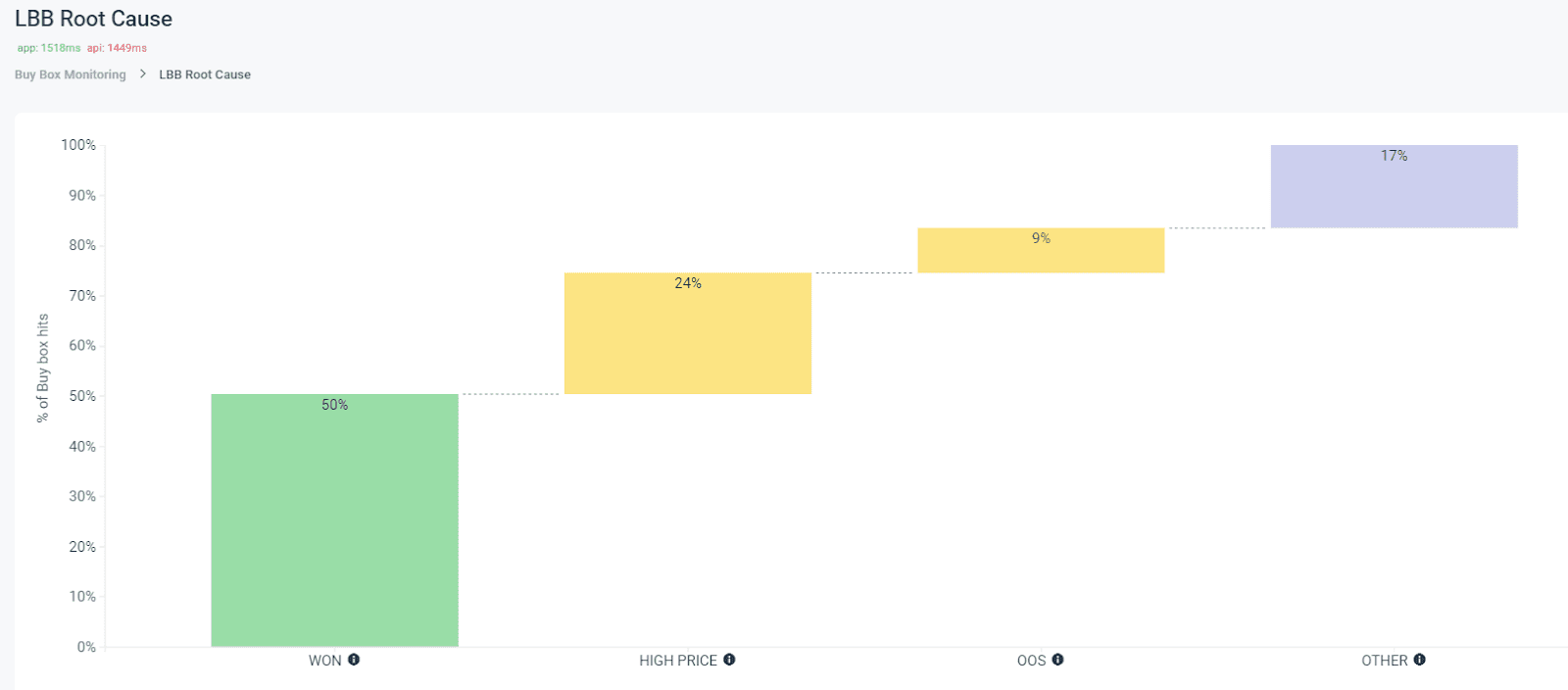

Yes, with the Ayolab LBB (Lost Buy Box) Root-Cause Analysis. As an illustration, find below the LBB Root-Cause Analysis for a random sample of DIY products. Here we try to understand why Amazon 1P lost the Buy Box 50% of the time, and it seems most of the time (in 24% of all occurrences) it was due to a cheaper competing seller:

When it comes to Amazon, renegotiating discounts, preferred sellers, inventory or reviewing any strategic decision should be supported with data-driven reporting.

From Actionable Data to Positive Results on Your Healthy Growth

Our Amazon Brand Success Quadrant enables brands to get a clear overview over their brand sell-out. More importantly, the playbook that comes along with our technology is not a one-fits all approach and depends on your strategy, commercial agreements and builds your existing resources. No additional spending required !

To deal effectively with poachers, the root-cause analysis of your LBB rate is essential to better anticipate negotiations with your preferred sellers on Amazon. Our aim is to turn sell-out made by Poachers into more green (= Healthy Growth Area, please refer to our blog post on the Amazon Brand Success Quadrant here).

It starts with a 30 min strategy call where you will learn

- How the Amazon Brand Success Quadrant works for you

- Where the hidden opportunities for healthy growth are available

- Step by step guideline on how you can move forward and take back control

Click here to book time with one of our marketplace analysts.